The EnerSys Thesis: From IRA Credits to the Data Center Boom

- Matthew B. Vargas

- Aug 25, 2025

- 7 min read

Strong near-term positioning supported by favorable sourcing, IRA Section 45X incentives, and the Bren-Tronics acquisition in defense.

Long-term demand stability driven by data center power requirements, increased lithium adoption, and recurring battery replacement cycles

Attractive risk-reward profile with expanding margins, disciplined cost reductions, shareholder returns, and a valuation below historical averages.

Overview

EnerSys designs, manufactures, and services industrial energy storage and power systems across three reportable segments:

Energy Systems: Integrated DC and AC power equipment, distribution, batteries, and thermally managed outdoor enclosures for telecom, broadband, data centers, and utilities/UPS. These include carrier cabinets, line-power systems, and data-center UPS strings.

Motive Power: Batteries and chargers for forklifts, automated guided vehicles, and industrial material-handling equipment, along with fleet energy management services.

Specialty: Defense and aerospace applications such as satellites, aircraft, and soldier-portable power, along with premium SLI and transportation. The 2024 Bren-Tronics acquisition expanded its soldier-portable lithium capabilities.

EnerSys appears undervalued relative to its long-term earnings potential, supported by strong positioning in domestic battery production, meaningful gross-margin enhancement from IRA Section 45X credits, and early leadership in higher-margin lithium and TPPL technologies. The company’s role in data center power stability, alongside steady recurring revenue from battery replacement cycles and secular growth in warehouse automation, provides a durable foundation for sustained earnings growth.

Although competition in lithium production and geopolitical uncertainty present short-term risks, EnerSys’s margin expansion, disciplined cost management, shareholder-friendly capital returns, and historically low valuation create a compelling risk-reward profile.

The Short Tail: Supply Chain Logistics and M&A

EnerSys is an intriguing company that appears to be well positioned for both short-term tailwinds and long-term secular trends. To understand the short-term setup, it is important to examine the company’s supply chain logistics and its recent acquisition.

Starting with supply chain logistics, a significant portion of the company’s Energy Systems business relies on battery production. Recently implemented tariffs have forced many companies to restructure their supply chains. EnerSys is in a relatively strong position. At present, 59 percent of sourcing is domestic within the United States, and another 19 percent comes from Mexico, which is currently exempt from major additional tariffs. This could change, but for now it provides meaningful insulation from policy volatility.

The remaining 22 percent of the supply chain does have tariff exposure. However, management has reflected a proactive approach by establishing a dedicated tariff task force to work on restructuring affected regions. The company also emphasized several long-standing buffers, such as ongoing onshoring from Chinese operations, dual sourcing, and region-by-region production strategies.

This connects directly to one of the major short-term tailwinds. EnerSys is positioned to benefit significantly from the IRA Section 45X Advanced Manufacturing Production Credit, which became effective in 2023. About 90 percent of U.S.-sourced battery production already qualifies. This incentive is a key reason EnerSys has begun shifting even more production to the United States, including closing its Monterrey factory and expanding its Kentucky operation. The credit runs through 2032 and provides a substantial and tangible boost to gross margins.

The company also maintains a small but meaningful specialty line with exposure to defense. This segment was strengthened further through the acquisition of Bren-Tronics, which expanded EnerSys’s portfolio of soldier-portable lithium batteries and ruggedized defense electronics designed for adverse conditions. Combined with broader tailwinds across the defense industry, this acquisition established a solid foothold in a lucrative and opportunity-rich defense market, particularly within NATO contract channels where Bren-Tronics had strong expertise.

In the most recent quarterly earnings call, management stated that defense segment order activity was robust due to global geopolitical dynamics, although U.S. aerospace and defense revenue paused temporarily because of procurement personnel changes. They also noted that lithium battery factory plans are currently on hold pending government discussions expected next quarter.

The Long Tail: Data Centers and Recurring Revenue Streams

While the current geopolitical environment and short-term setup are strong on their own, the core investment thesis revolves around the long-term growth of data centers and the recurring revenue streams they create.

The data center economy is a crucial component of AI infrastructure and will remain so for decades. Every data center requires several specialized roles. EnerSys does not participate in the more visible components such as servers, IT hardware, cooling systems, or direct power supply. Instead, its equipment acts as a temporary downtime system and a stabilizer in the event of power disruptions. EnerSys regulates power flow, ensuring that grid AC power is properly converted into DC power for servers.

The most important offering is the company’s zero-downtime guarantee. Its battery systems provide temporary backup and stabilization during power shortages or full outages. These events can range from a few seconds to several minutes. The systems are designed so that servers never notice the disruption.

EnerSys offers three types of batteries, each with different capabilities and margin profiles:

Flooded lead-acid:

Lowest cost and most commoditized

Requires heavy maintenance

Lowest margins

TPPL (Thin-Plate Pure Lead):

An EnerSys specialty product (NexSys)

Maintenance-free with better energy density and longer lifespans

Premium pricing and mid to high margins

Lithium-ion:

Highest average selling price

Long cycle life and fastest adoption rate across forklifts, defense, and data centers

High margins but capital intensive to scale

Historically, data centers relied on flooded lead-acid batteries, and many still use them today. TPPL batteries are increasingly common. Lithium-ion, however, is growing at the fastest rate because of its long life cycle and higher energy density, which translate into lower operating expenses.

This is highly advantageous for EnerSys, which already has a strong TPPL presence and offers high-quality lithium batteries with the highest margins. As lithium adoption becomes more widespread, EnerSys should experience meaningful bottom-line improvement.

Even when customers choose lead-acid batteries, EnerSys still benefits from recurring service revenue. Lead-acid batteries have shorter lifespans, typically three to five years, which creates ongoing demand for replacement, monitoring, disposal, and recycling. These recurring services allow EnerSys to generate stable revenue even if data center construction eventually outpaces demand.

For those who believe the AI boom could be temporary or that data center build-outs might slow, these recurring aftermarket services address that concern directly. Existing clients continue to produce long-term recurring revenue through maintenance cycles.

The Motive Segment

The Motive Power segment is one of EnerSys’s largest and highest-margin business lines. It contributes more than 40 percent of company sales and operates at a 13 to 14 percent margin. This segment supplies battery solutions for warehouses and logistics operations, primarily supporting automated guided vehicles and forklifts.

Although growth in this segment is expected to be more moderate compared to Energy Systems, meaningful tailwinds persist. These include warehouse expansion fueled by e-commerce growth and a longer-term trend toward automation. Businesses continue to adopt AGVs and robotic systems, and they have been early adopters of lithium-ion batteries relative to the data center or telecommunications sectors. This is one reason margins in Motive Power remain higher. If these trends continue, EnerSys could see strong top-line and bottom-line contributions from this segment.

Risks & Concerns

There are concerns about how quickly EnerSys can increase lithium-ion production to match demand as industries transition from lead-acid to lithium systems. The company is constructing a large-scale lithium facility that will significantly increase production capacity, but it is not expected to be completed until fiscal year 2029.

In the meantime, the company faces competition in the lithium market. One major competitor is BYD, which is also one of the largest holdings in The Benjamin Fund. With the long lead time before EnerSys increases its lithium capacity, there is a window for competitors to capture market share.

Another concern is geopolitical risk. While EnerSys is onshoring production to mitigate these risks, global political and trade environments remain unpredictable. Shifts in policy or procurement rules can disrupt supply chains across all segments.

Valuation, Financials, and Shareholder Value

EnerSys appears attractively valued. The company trades at about 11 times earnings, which is well below its long-term average range of 18 to 22 times. The last period in which the stock traded at this level was March 2020 following the COVID-19 crash.

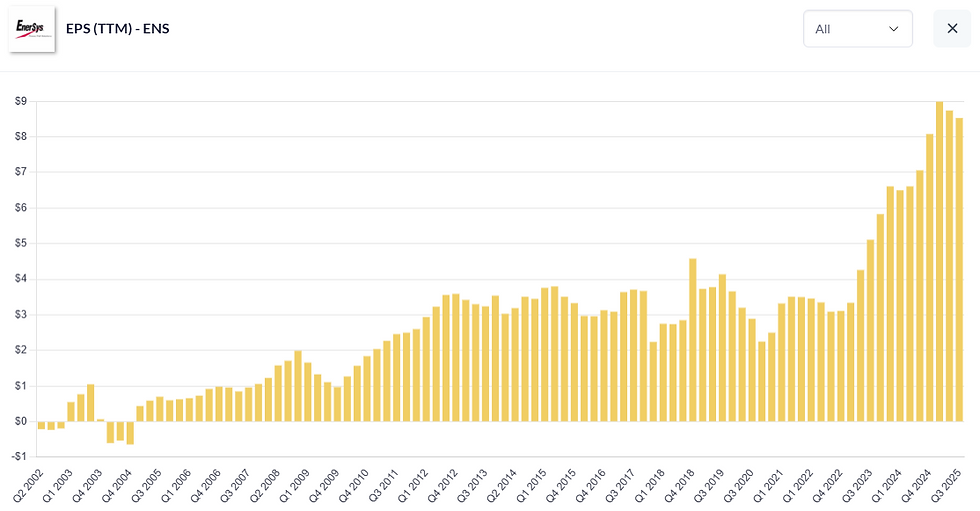

Fundamentally, the company is stronger than ever. EPS growth has averaged about 8.7 percent since 2002. Over the past two years, annualized EPS growth has surged to about 30.8 percent. The five-year average is just under 25 percent. Revenue growth has been more modest. Two-year annualized sales growth is slightly negative, and the five-year average is around 4 percent, which is close to the long-term trend of 4.2 percent.

EnerSys has recently prioritized returning capital to shareholders. The company has accelerated share repurchases, reducing share count by approximately 3 percent in recent years. It also raised its dividend from 70 cents in the second quarter of 2023 to 98 cents in the third quarter of 2025. Even with this increase, the payout ratio remains healthy at slightly above 10 percent.

The company has taken meaningful steps to improve cost efficiency. Management is targeting more than 80 million dollars in savings by fiscal year 2026, supported by an 11 percent reduction in its nonproduction workforce. Management also emphasized an organizational realignment designed to increase agility, decision speed, and operational clarity. Finally, there has been recent insider buying, mostly in the weeks before earnings in early August at an average price near 88 dollars. Insider buying is often a positive signal and reflects executive confidence in the future of the business.

Conclusion

EnerSys presents a balanced and compelling investment case supported by both immediate catalysts and durable long-term drivers. The company’s advantageous supply chain positioning, strong eligibility for federal manufacturing incentives, and recent expansion into defense provide meaningful short-term strength. Over the longer horizon, its role within data center infrastructure, ongoing transition toward higher-margin battery chemistries, and the recurring nature of its replacement and service cycles establish a stable foundation for continued growth.

Although competition in lithium production and geopolitical uncertainty introduce valid risks, EnerSys’s margin expansion, shareholder-oriented capital allocation, and attractive valuation suggest favorable risk-reward potential. Taken together, the company appears well positioned to benefit from a mix of cyclical and structural trends that could support sustained performance in the years ahead.

Comments